42 is a gift card taxable

Eyeshadow Emporium – Devinah Cosmetics Shopping for someone else but not sure what to give them? Give them the gift of choice with a Devinah Cosmetics gift card. Give them a fun shopping experience and let them pick what they like best. They will definitely think YOU are awesome! Gift cards are delivered by email. Our gift cards have no additional processing fees. Are Gift Cards Taxable Income? | Sapling Gift cards, however, are not among them. They usually say right on the card exactly how much they're worth, be it $5 or $500 -- and when they do, the Internal Revenue Service views them as equivalent to cash. That means they might be considered taxable income, depending on who gives them to whom. Gifts Are Not Income

2021-2022 Gift Tax Rate: What It Is And How It Works | Bankrate 02/11/2021 · The gift tax imposes a tax on large gifts, preventing large transfers of wealth without any tax implications. It is a transfer tax, not an income tax. …

Is a gift card taxable

Frequently Asked Questions on Gift Taxes - IRS tax forms The general rule is that any gift is a taxable gift. However, there are many exceptions to this rule. Generally, the following gifts are not taxable gifts. Gifts that are not more than the annual exclusion for the calendar year. Tuition or medical expenses you pay for someone (the educational and medical exclusions). Gifts to your spouse. Gifts to a political organization for … Dutch Bros Coffee Gift Card Gift Card Shipping. We offer FREE Standard Mail Service (5-7 Day) for all Domestic Gift Card orders. The Post Office lists Standard Mail Service as 2-3 business days for typical delivery, but please allow 7-10 days for processing and delivery. We are not responsible for delays in mail service due to holidays, adverse weather or situations outside of our control. Gift Cards are … Gift Tax | Internal Revenue Service 04/02/2022 · The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. The tax applies whether or not the donor intends the transfer to be a gift. The gift tax applies to the transfer by gift of any type of property. You make a gift if you give property (including money), or ...

Is a gift card taxable. Are gift cards taxable employee benefits? | PeopleKeep Yes, gift cards are taxable when offered to employees. The IRS considers it as cash-equivalent, meaning you must report the card's value on an employee's Form W-2 just like a wage. This is the same as taxable fringe benefits such as employee stipends, which must also be reported as wages on employees' W-2s. IRS Issues Guidance on Treatment of Gift Cards - The Tax Adviser Gift Card Income In general, Sec. 451 and the regulations thereunder require accrual-method taxpayers to include an item in gross income when the all-events test is met or, as interpreted by the courts, at the earliest of when it is received, due, or earned ( Schlude, 372 U.S. 128 (1963); Rev. Rul. 84-31). When buying gift cards, make sure you aren't charged sales tax. The sales tax on the monetary value of the gift card is charged when the recipient ultimately uses the card to make purchases, therefore no state in the U.S. requires retailers to charge sales taxes on the purchase of gift cards. This applies to both gift cards for shopping at local retail stores and the ones you use with online retailers like ... Gas cards and gift cards: Are they taxable benefits, or not? A: Yes. The gift card is considered remuneration for services performed. The fact that the manager paid out of pocket isn't relevant because the supervisor is the employer's agent. WHAT TO READ NEXT

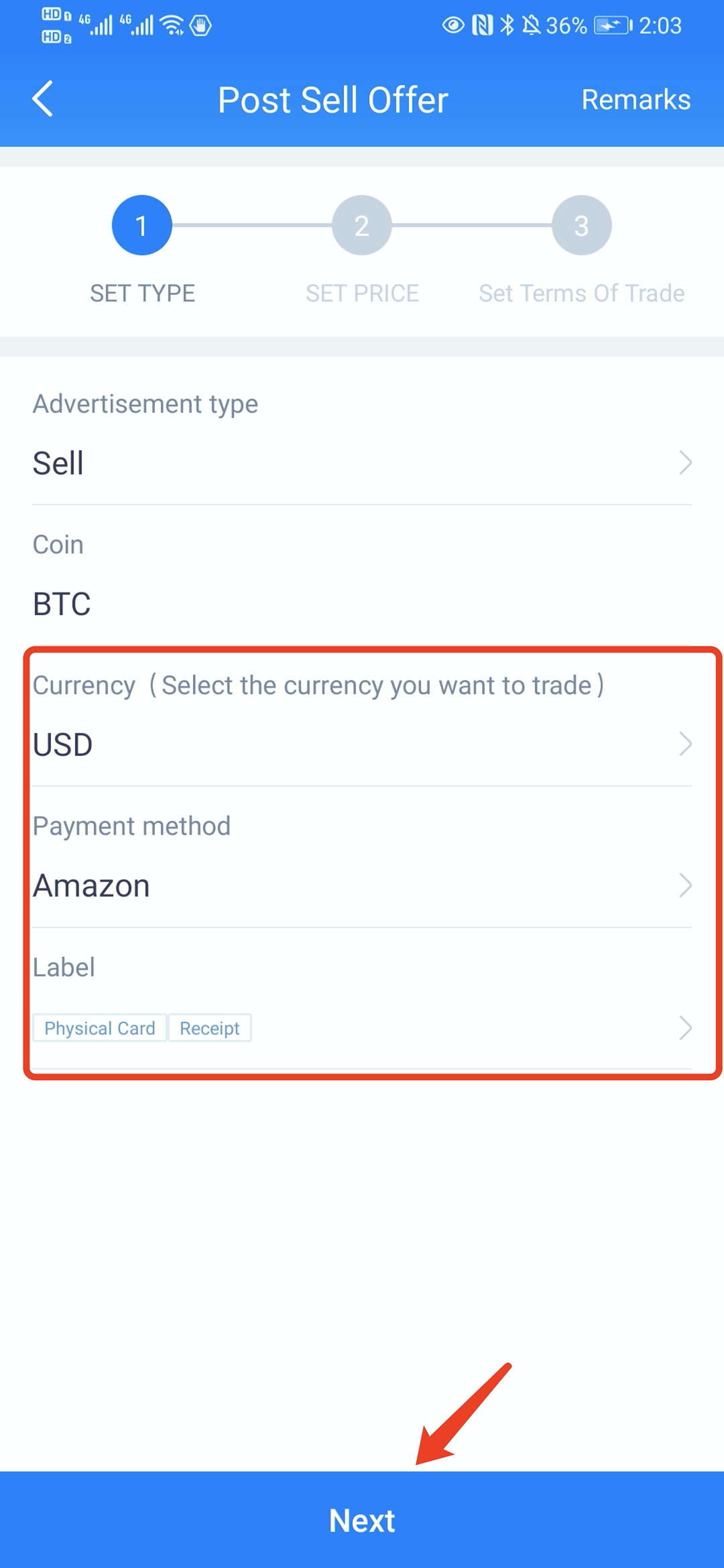

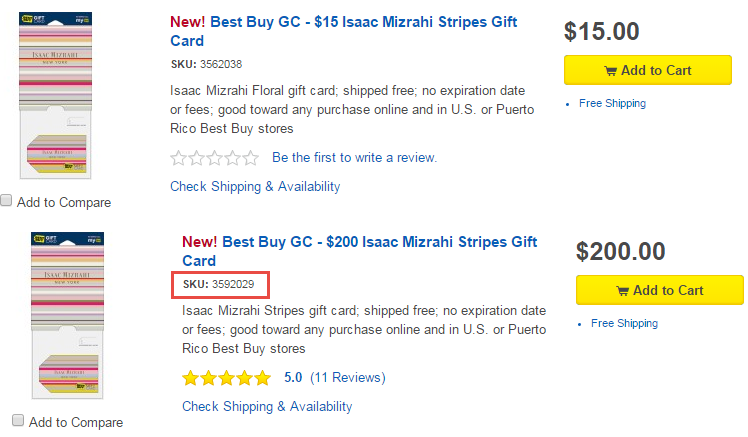

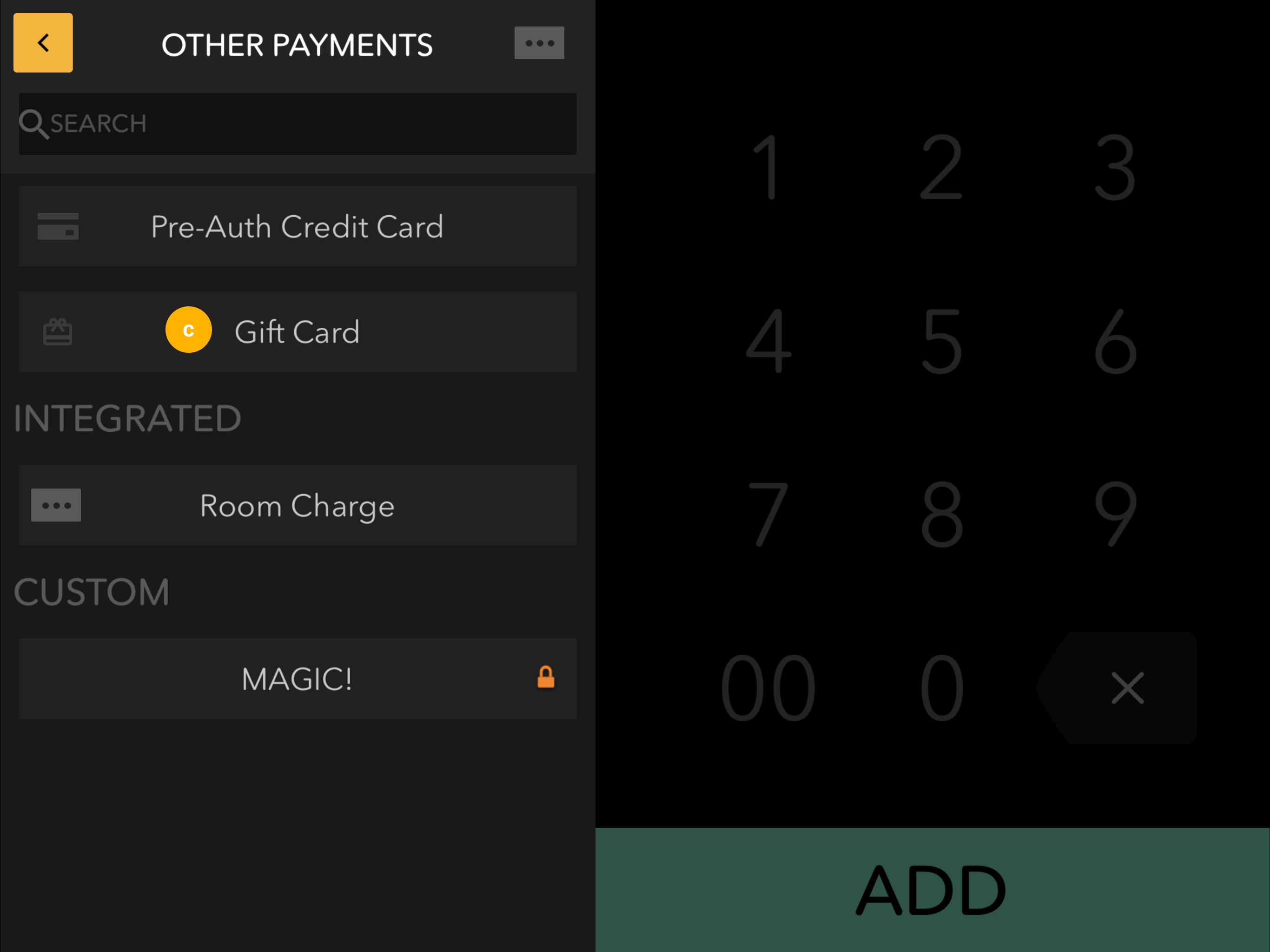

Small Business Gift Cards Guide & Best Digital Gift Card Systems 10/05/2022 · Gift cards for small business are no longer optional for most restaurant, retail, or service-based companies. Moreover, businesses can benefit from a digital gift card system that allows customers to redeem an electronic gift card from their smartphone (though many consumers still prefer physical to digital cards).Here are just a few of the many benefits offered … Ask the Expert: Are All Gift Cards Taxable Income? So the short answer would be that any gift card that serves as a cash equivalent - for example, a $25 Amazon.com gift card or a Visa cash card - would always be taxable regardless of the amount because there is no difficulty in accounting for the monetary value of the gift. Are Employee Gift Cards Taxable? - Stratus.hr® Because gift cards are essentially the same as cash, they are considered an easy item to be accounted for and, therefore, taxable. Bottom line: no matter the amount, a gift card given to employees is not considered a de minimis fringe benefit. Instead, it should be included in wages on Form W-2 and subject to tax withholdings. Biden Pushes For 3-Month Gas Tax Holiday - Forbes Advisor A federal gas tax holiday would temporarily suspend federal taxes on gasoline. The result would be a price reduction of up to 18.4 cents per gallon on gas and 24 cents per gallon on diesel. On ...

Gift Tax FY 2021-22: What is Gift Tax? & Exemptions of Tax on Gifts The gift tax is also applicable on certain transfers that is not considered as a gift. The transfer of existing movable or immovable property in money or money’s worth qualifies for gift tax. Gift Tax Exemptions. Though gift tax is applicable on gifts whose value exceeds Rs.50,000, the gift is exempted from tax if it was given by a relative ... Gift Cards are Taxable! - Southwestern University Per IRS Regulations, gift cards are taxable to the recipient and must be reported as income to the IRS. In addition, because the IRS considers them to be cash equivalents, there is no de minimis value (see 2018 IRS Publication 15-B page 9 De Minimis (Minimal) Benefits). All cash and cash equivalents must be reported on a tax return. Are Gift Cards For Employees Considered Tax-deductible? While the expense of the gift card is completely payable by the company, you must pay tax from the worker's compensation for all these incentives. • Employee protection and performance rewards of real property, such as a watch, can be deducted up to $400 per year per worker. Employees do not have to pay taxes on their awards, but they must ... Are Employee Gifts Taxable? Everything You Need To Know Gift certificates, gift cards and cash equivalent benefits are never tax-exempt This is something the IRS is very clear about. Even if they are given out as holiday or birthday presents from an employer to an employee, these types of gifts are never considered de minimis fringe benefits, and are thus liable to taxation.

Are Gift Cards Taxable? | Taxation, Examples, & More 11/12/2020 · Let’s say you wanted to give an employee a $100 gift card for the holidays. You decide to use the percentage method for federal income tax. Follow these steps to determine how much to withhold from the gift card for taxes: First, multiply the gift card value by 22% to find the federal income tax: $100 X 0.22 = $22.00

Are Gift Cards Taxable to Employees? - Eide Bailly According to the IRS's gift card tax rules, since cash and cash-equivalent fringe benefits like gift certificates have a readily-ascertainable value, they do not constitute de minimis fringe benefits. This means that businesses must report gift cards as part of an employee's wages on the Form W-2. Furthermore, if the employee is covered for ...

Are Gifts for Your Team and Clients Tax Deductible in the U.S.? Team Gift Type 2: Gift Cards and Certificates. Gift cards and gift certificates are considered taxable income to employees because they can essentially be used like cash. The cost of the gift card is fully deductible to the business, but you must withhold taxes from the employee's pay for these gifts. Team Gift Type 3: Awards

Allowance in Salary - What are Allowance? - Taxable & Non ... Servant/helper Allowance: Amount provided for hiring a servant is fully taxable in the hands of an employee. Partly Taxable Allowances . House Rent Allowance: HRA is offered to meet the residential rent expenses of the employee for its accommodation. It is partially exempt u/s 10(13A), and the remaining amount after deduction is taxable.

Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages Employers planning on giving gift cards this season should remember that the IRS regulations support treating all gift cards and gift certificates provided to an employee as taxable income.

Gift cards - Canada.ca You can’t redeem a gift card for cash. Usually, gift cards: come with money already on them; don’t expire; don’t have fees; Sometimes, you can add money to a gift card. If your gift card is old, you may need to get the money on it transferred to a new card. Make sure you read the terms and conditions of any gift card you buy or use.

Are gift cards taxable? | Kroger Gift Cards Yes, gift cards are taxable when received when given to an employee from an employer. Employees will have to claim any funds received on gift cards from their employer in their tax return. Employers will also have to pay tax on any gift cards they give to employees. The IRS will expect tax to be paid on gift cards, even in values as low as $5.

Frequently Asked Questions on Gift Taxes - IRS tax forms In other words, if you give each of your children $11,000 in 2002-2005, $12,000 in 2006-2008, $13,000 in 2009-2012 and $14,000 on or after January 1, 2013, the annual exclusion applies to each gift. The annual exclusion for 2014, 2015, 2016 and 2017 is $14,000. For 2018, 2019, 2020 and 2021, the annual exclusion is $15,000.

Taxability of Gift Certificates | Payroll Services | Washington State ... Taxability of Gift Certificates The IRS has recently issued an opinion that gift certificates, gift cards, gift coupons which have a face value on them are considered cash equivalents and therefore are subject to employment taxes without regard to their value. This includes gift certificates which cannot be converted to cash.

Received a gift card? It could be taxable too - Zee Business In the case where the amount on the gift card exceeds the taxable amount, then tax is levied accordingly. Under the Section 56 (2) (x) of the Income-Tax Act, 1961, tax is levied on gift card will have the Fair market value minus the consideration levied on it, if the FMV exceeds by Rs 50,000. Watch Zee Business Live here:

Can I give my employee a gift card without being taxed? Because gift cards are essentially the same as cash, they are considered an easy item to be accounted for and, therefore, taxable. There used to be a threshold of $25 to be the maximum amount that could be gifted before having to be taxed, but that is no longer the case. A gift card or cash equivalent is now taxable, regardless of the amount.

Gifts, awards, and long-service awards - Canada.ca A gift or an award that you give an employee is a taxable benefit from employment, whether it is cash, near-cash, or non-cash. However, we have an administrative policy that exempts non-cash gifts and awards in some cases. Cash and near-cash gifts or awards are always a taxable benefit for the employee.

How do I report a gift card that is taxable when filing for taxes? June 1, 2019 10:34 AM. You can include the value of the gift card as " Other Income " on your Tax Return by following these steps: Sign In to TurboTax Online. Click " Take Me to my Return ". Click " Federa l" from the left side of your screen. Scroll down to " Less Common Income " and click " Show More ". Click " Start " to the right of Form ...

Are gift cards from rewards sites taxable as income? - Intuit Cash or cash equivalent items provided by the employer are never excludable from income. An exception applies for occasional meal money or transportation fare to allow an employee to work beyond normal hours. Gift certificates that are redeemable for general merchandise or have a cash equivalent value are not de minimis benefits and are taxable.

Are Employee Gift Cards Considered Taxable Benefits? HR Answer: Yes, it's true! According to the IRS, cash, gift certificates, and gift cards are considered taxable fringe benefits and must be reported as wages. But you may be relieved to know that this rule doesn't apply to all gifts or perks that you may give to employees.

Should I tax customers for gift cards? - Avalara More important, however, is that recipients of gift cards are going to be charged sales tax when they use their card -- if the state they're shopping in imposes a tax on the product they've purchased. For example, if you send your cousin in Pennsylvania a Banana Republic gift card, she won't need to pay sales tax on clothing when she uses it.

Gift Card Accounting, Part 2: The Rules for Tax This means that on the 2017 tax return, they will recognize these amounts from their sales of gift cards: The outstanding balance of cards sold in 2015 at 12/31/17 = $920. The 2017 tax return for Lesley's Books will show gift card revenue of $14,744, while the actual redemptions are $13,858.

0 Response to "42 is a gift card taxable"

Post a Comment